Calculate computer depreciation tax

This free downloadable PDF is fantastic for calculating depreciation on-the-go or when youre without mobile service to. With this method the depreciation is expressed by the total number of units produced vs.

Method To Get Straight Line Depreciation Formula Bench Accounting

The average computer lasts 10 years so it decreases in value by 10 each year.

. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. The total number of units that the asset can produce. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

How to use the Tax Depreciation Calculator. You can take a deduction for depreciation of 800 each year on your business tax return. Depreciable amount Units Produced This Year Expected Units of.

DOWNLOAD THE CLAIMS PAGES DEPRECIATION GUIDE. Choose Property Type Construction Type Quality of Finish Estimated Year of Construction Estimated Floor Area Year of Purchase State then. Where Di is the depreciation in year i.

Deductible amount for computers used less than 100 percent of the time for business equals the cost of computer times the percentage used. For example a computer. Depreciation per year Asset Cost - Salvage.

It provides a couple different methods of depreciation. Cost Scrap Value Useful Life 5050 505 1000 The annual depreciation expense for Ali would. Cost Scrap Value Useful Life.

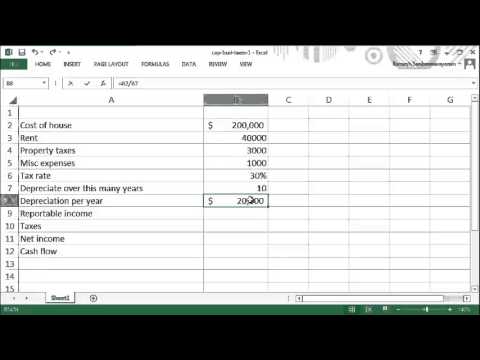

Base value days held see note. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. The MACRS Depreciation Calculator uses the following basic formula.

The formula to calculate annual depreciation through straight-line method is. This limit is reduced by the amount by which the cost of. Section 179 deduction dollar limits.

Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable Computers including laptops and. The highlighted formula shows the first year calculation as one twelfth of the annual amount meaning the asset started depreciating in the last period of your year. D i C R i.

This depreciation calculator is for calculating the depreciation schedule of an asset. Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the. First one can choose the straight line method of.

For example rental buildings are classified under Class 1 and must be depreciated at a 4 rate. Each asset class comes with its own depreciation rate and calculation method. C is the original purchase price or basis of an asset.

The tool includes updates to reflect tax depreciation. The formula to calculate annual depreciation through straight-line method is. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS Except for.

How To Calculate Depreciation

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon

Different Methods Of Depreciation Calculation Sap Blogs

Using Spreadsheets For Finance How To Calculate Depreciation

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

How To Calculate Depreciation Expense For Business

How To Prepare Depreciation Schedule In Excel Youtube

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Compute Cash Flow After Depreciation And Tax Youtube

How To Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

What Is Macrs Depreciation Calculations And Example

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Under Income Tax Act Depreciation Under Section 32 Of Income Tax Act Youtube

Which Method Of Depreciation Gives The Highest Net Income

Depreciation Formula Calculate Depreciation Expense